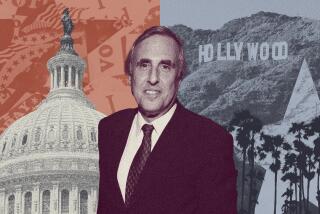

Held Able to Stand Political Heat : Fed Nominee Respected for Hard Work, Integrity

- Share via

WASHINGTON — Robert M. Ball, a staunch liberal, was worried about being one of just five Democrats on a 15-member commission appointed to rescue the failing Social Security system in 1982. But the Republican chairman, conservative economist Alan Greenspan, quickly dispelled Ball’s fears.

“He was very fair, he got the confidence of all of us on the Democratic side very quickly by letting us share in staff selection and in making the agenda,” said Ball, a former head of the Social Security Administration. “He is a true conservative, but he is also someone who really wants to understand the other person’s point of view.”

Nevertheless, to succeed as the new chairman of the Federal Reserve Board, Greenspan will need all his political and diplomatic skills, his intense appetite for work and a good helping of luck. He must steer the Fed on a delicate course, winning the confidence of financial markets and foreign leaders without unduly antagonizing President Reagan and Congress.

The Fed will try to keep the dollar stable without stifling the domestic economy. A falling dollar raises the cost of imported goods, forcing Americans to pay higher prices, and discourages foreign investors from buying the U.S. government securities issued to finance the huge federal budget deficit.

The Fed keeps the dollar on an even keel by driving up interest rates, resulting in more costly home mortgages and higher rates for business borrowing. But, if rates get too high, they can plunge the economy into recession.

To Be Under Pressure

With an election year coming, the Fed under Greenspan, composed entirely of members appointed by President Reagan, will be under pressure from the White House and Congress to supply enough money to ensure healthy economic growth.

The Fed nominee can stand the political heat, said M. Kathryn Eickhoff, a former chief economist at the Office of Management and Budget who worked with him for 23 years at the Townsend-Greenspan economic consulting firm.

“I think Alan has been noted, above all else, for personal and professional integrity,” she said. “The idea that he would manipulate monetary policy for a political purpose is simply not credible.”

Greenspan enjoys immense respect in and out of government as a hard worker with a level head. In helping to fashion the final Social Security rescue plan that became law in 1983, consisting of a package of higher taxes and benefit restrictions, Greenspan never raised his voice in anger while huddling privately with one commission faction or another.

No Leaks to Press

And, before the commission worked out its compromise, Greenspan did not leak a word to the press--displaying a kind of discretion that is extraordinary in Washington but vital for a Fed chairman, whose every word can send stocks soaring or plunging.

Greenspan had dinner in Washington with several reporters Monday night but never gave the slightest hint that he was about to get one of the nation’s most powerful jobs, chairman of the Federal Reserve Board, even though the decision had already been made.

“That’s typical Alan. He didn’t give me a clue, either,” said Eickhoff, who ran Townsend-Greenspan while Greenspan served for three years as chairman of the Council of Economic Advisers. He was appointed to the job by former President Richard M. Nixon during the last days of the Watergate scandal in 1974 and remained in the post during the Gerald R. Ford Administration.

The financial community, which has lavished praise on outgoing Chairman Paul A. Volcker for fighting inflation, seems well satisfied with Greenspan as second choice to head the Fed.

Not ‘Out on a Limb’

“He is perhaps the ideal candidate in the absence of Volcker,” said Donald Straszheim, chief economist at Merrill Lynch, the giant brokerage firm. “He is concerned about the federal deficits and inflation, and he knows how to read the numbers on the economy. He is near the main trunk among economists, not way out on a limb.”

Moreover, from a political standpoint, the Greenspan nomination is “a shrewd choice,” said Richard Rahn, chief economist of the U.S. Chamber of Commerce. “He is respected, neither an unknown nor a flake.”

Greenspan is a basic traditional conservative with a fervent belief in limiting the government’s role in regulating the economy whenever possible.

But he has never been a staunch follower of monetarism, the concept that a carefully controlled money supply is the key to sound economic policy. Nor did he embrace President Reagan’s enthusiasm for supply-side economics, which held that a big tax cut could pay for itself without expanding the budget deficit.

Mastery of Details

Instead, Greenspan’s focus has been pragmatic, studying closely the performance of U.S. business. His professional peers speak admiringly of his mastery of the details of industrial profits and currency fluctuations.

“For a macro-economist, he is unusually attuned to the markets,” said Fred Bergsten, a Treasury official during the Jimmy Carter Administration and now president of the Institute for International Economics.

Greenspan has a reputation for devoted hard work. A fellow Wall Street economist, speaking anonymously, described him as a “monomaniac in the best sense of the word, consumed by his profession.”

He is believed to be a wealthy man, although his firm, founded with the late William Townsend in 1953, will not disclose its revenues or Greenspan’s share of its profits. But the roster of clients includes many of the nation’s biggest firms, in manufacturing, retailing and insurance.

$10,000 Per Speech

In addition, Greenspan makes money as one of the most sought-after speakers for business meetings, charging a fee of $10,000 or more, although he doesn’t offer the verbal fireworks or brash self-confidence of a Lee A. Iacocca.

His delivery is quiet and professorial. But it’s leavened with some dry wit.

“I think of him as a quiet person, not very outgoing,” Eickhoff said. “It always surprises you when he says something in a funny sort of way. He’ll make a deadpan, wry comment.”

The 61-year-old Greenspan is a native New Yorker, with bachelor’s, master’s and doctoral degrees from New York University.

Greenspan once played the saxophone in a traveling jazz band but, after some months on the road, returned home to attend college. “Economics held a brighter future than the music business,” he said.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.