PG&E; Net Falls, but Results Top Forecast

- Share via

PG&E; Corp.’s net income fell 55% in the third quarter as the loss of customer payments from the energy crisis overshadowed rebounding profit at its utility, California’s largest power provider.

Net income at the parent company fell to $228 million, or 53 cents a share, down from $510 million, or $1.23, a year earlier. It was the San Francisco company’s first full quarter since its flagship subsidiary, Pacific Gas & Electric Co., emerged from Bankruptcy Court protection in mid-April.

Boosted by a 45% increase in utility earnings, the parent company’s operating profit totaled $242 million, or 57 cents a share, up from $174 million, or 42 cents, in the third quarter of 2003. The performance topped analysts’ forecast of 53 cents a share, according to a survey by Thomson First Call.

“I think they’re on track,” said Jefferies & Co. analyst Paul Fremont, who rates PG&E; shares a buy. “They came in on the quarter significantly better than expected.”

PG&E; shares sagged 89 cents to $31.57 on the New York Stock Exchange, after hitting a 52-week high of $32.55 a share Monday.

“We’ve delivered another solid quarter and expect the full year to be solid as well,” PG&E; Chief Executive Robert D. Glynn Jr. said in a conference call. Glynn said he expected 2004 operating earnings to reach the high end of the previously predicted range of $2 to $2.10 a share.

PG&E;’s improved operating results are being powered by a turnaround at its utility, which filed for bankruptcy protection more than three years ago amid a statewide electricity crisis that left energy companies struggling to pay soaring wholesale power prices.

After the crisis subsided, part of the cleanup included allowing Pacific Gas & Electric to collect millions of dollars in “headroom” -- the difference between retail rates and the falling wholesale cost of power -- to offset losses during the 2000-01 energy market meltdown. Such payments boosted the utility’s earnings by $495 million in the third quarter of last year but no longer are included in net income.

Pacific Gas & Electric’s third-quarter earnings soared on higher rates approved this year by state regulators, as well as several one-time items related to the aftermath of the crisis and bankruptcy proceedings.

Noting that the company had “very substantial cash available,” Glynn said PG&E; plans to distribute $1.75 billion to shareholders by the end of 2005 through dividends and stock buybacks. The first phase of the plan includes establishing stockholder dividends of 30 cents a quarter -- slated to start in April -- and repurchasing $350 million worth of PG&E; stock before the end of 2004.

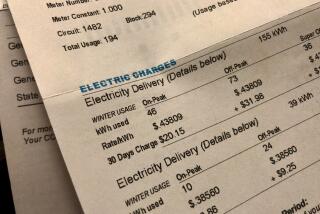

Consumer advocates have complained that Pacific Gas & Electric’s success has come on the backs of its customers, who pay electricity rates that are among the highest in the country.

The utility recently was slapped by the California Public Utilities Commission for estimating too many customer bills and for failing to prevent a December outage that left 100,000 customers in San Francisco without power at a cost of more than $4 million.

The PUC said the outage could have been avoided if the utility had implemented recommendations that followed a 1996 outage.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.