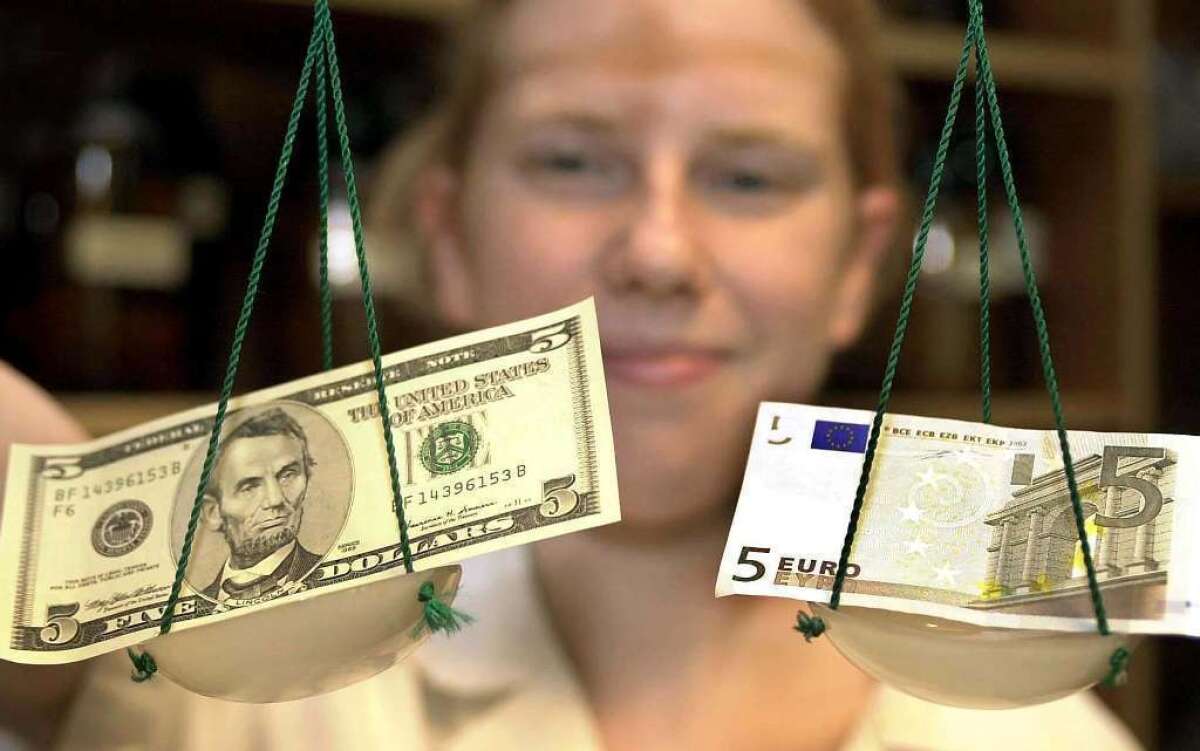

European vacations more expensive as dollar falls to 7-month low

- Share via

Europe, and most of the world, is getting more expensive for U.S. travelers.

While the Federal Reserve’s surprise decision to continue pumping money into the economy caused stock markets throughout the world to rally, it led to further erosion of the dollar’s value against its international peers.

The U.S. currency fell the most against Brazil’s real and Turkey’s lira after Fed policymakers chose to await news of economic progress, including holding its interest-rate target at almost zero until unemployment falls below 6.5%.

“The lack of tapering and lack of adjustment to the unemployment threshold is driving the dollar lower,” Vassili Serebriakov, a foreign-exchange strategist at BNP Paribas told Bloomberg News.

Photos: Top 10 Southern California companies

The dollar was valued Tuesday morning at $1.3542 per euro after reaching $1.3569, the weakest since February.

Mitul Kotecha, global head of foreign exchange strategy at Credit Agricole in Hong Kong, told Bloomberg television that he believes the U.S. economy will continue to improve and drive up the dollar’s value.

“I still think the dollar drop will be short-lived,” he said. “The reality is the Fed will taper going forward. ... They may do it at the next meeting. The economy is recovering. The job market is improving.”

ALSO:

Sales of existing homes top six-year high in August; prices up

In JPMorgan case, a rare admission: bank broke the law

What would you pay first: your mortgage or credit card bill?

Follow Stuart Pfeifer on Twitter

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.